Benefits Of Open Finance For Businesses And Consumers

Lately, open finance is all the rage and the technology, and legislation resulting from it, could negatively impact the financial marketplace. Open finance can create an atmosphere that could unleash new opportunities for businesses and consumers. But what exactly is open finance, and how does it differ from banking? This article will help you understand the difference between the two and explore what the future holds.

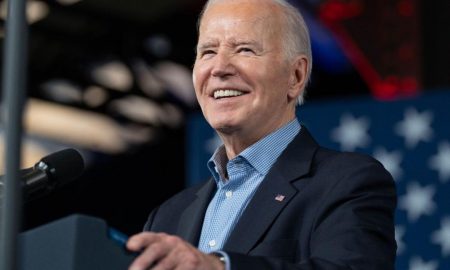

Maitree/Pexels | Companies can create better customer savings plans through open banking.

Open Finance Is The Future Of Open Banking

Open banking is the process where regulated companies open access to users’ financial data. This can greatly impact the consumer and financial landscape for the coming years by making it easier for businesses to expand quickly in new markets. The PSD2 legislation opened its APIs to allow consumers to give controlled access to third parties to their banking data.

This will be a step towards leveling the financial grounds by allowing fintech to flourish. In today’s world, open banking solutions allow investors to process funds through thousands of EU and UK banks through a single integration. Talking about the UK, open banking use has increased in popularity, reaching more people. In July 2020, 15 million API calls increased to around 33 million just after two years.

Is Open Finance Same As Open Banking?

Open finance can be seen as open banking 2.0 that expands the protocol with value-added services, which can allow greater and more secure data sharing. Open banking, like open finance, gives access to features like future-dated payments, recurring payments, and payments to various counterparties.

Open banking currently allows involved companies to access information related to expenses to pay credit checks and maintain a good credit score to qualify for loans in the future. The concept of open finance gives more information than a traditional bank account. Information on whether the user invests money and in what sectors or do they have paid their taxes, or how much they have in pension savings.

Pixabay/Pexels | Open market will allow banks to offer many other services than the traditional ones.

The ability to have answers to the above questions may allow merchants to provide personalized services to customers beyond the simple issuing and approval of credit. As the financial sector continues to evolve, companies will be able to help set up better saving and investment plans for their customers. The evolution of finance technology can open a wide range of benefits to HR, utility companies, pension funds, and mortgage lenders. The UK and Europe have been early adopters of open banking and the trend to adapt to open finance.

Pixabay/Pexels | Open finance can offer opportunities for businesses to grow.

As open banking continues to develop, traditional banks and fintech providers move towards exploring opportunities that may give rise to innovative products. Banks and their customers will continue to benefit by linking more services and customer accounts. A recent study involving 758 financial banks and professionals revealed that 85% of respondents agreed that open finance would positively impact the finance industry.

Many businesses use open banking to make better decisions about customers’ spending habits and income. Moreover, open finance also allows them to analyze the financial patterns of customers to get an insight into customers’ financial profiles.

More in Financial Planning

-

`

The Epic Battle: Unveiling the Epic vs. Google Legal Showdown

In a déjà vu moment for tech enthusiasts, Fortnite publisher Epic Games is gearing up for a legal battle against Google,...

December 6, 2023 -

`

Why Getting Loans From Your Bank Is Tougher Than Ever

Banks are ‘purposefully’ making the process of loans difficult. And there are multifarious reasons. New regulations are continually being introduced to...

November 27, 2023 -

`

The EU Sets 40% Women Workplace Quota to Boost Gender Equality

If there is a lesson we have learned from the corporate world over the years, it is that diversity is not...

November 18, 2023 -

`

Everything You Need to Know About Legal Asylum

You know, there is a word out there that has been both a beacon of hope and a subject of heated...

November 11, 2023 -

`

How to Avoid Hefty Energy Bills? 6 Effective Tips

The dreaded energy bill is no secret today. Every month, it drops in, and every month we wince, wondering, “How did...

November 3, 2023 -

`

Steve Harvey’s Financial Fall: Divorce From Mary Lee Harvey

Steve Harvey, the comedian and television personality we have all come to know and love, has seen his fair share of...

October 29, 2023 -

`

How Extreme Weather Can Sabotage Tourism-Based Small Businesses

Ever dreamt of owning a cozy beachfront café in Bali or a serene cabin retreat in the snowy Alps? If so,...

October 19, 2023 -

`

Everything You Need to Know About Debt Relief

Debt relief is a broad term that refers to strategies, plans, or programs that can help you reduce or eliminate your...

October 13, 2023 -

`

Money Management Tips to Improve Your Finances

Effective money management is the cornerstone of financial stability and achieving your long-term financial goals. Regardless of your income level, mastering...

October 6, 2023

You must be logged in to post a comment Login