Why BNPL is Here to Stay

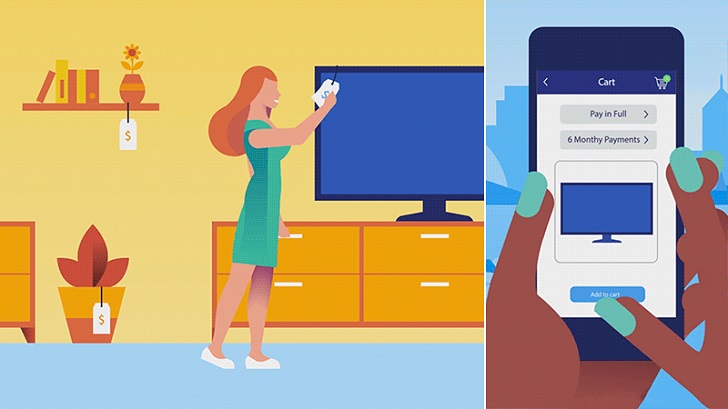

Buy Now Pay Later (BNPL) services have recently gained immense popularity. They provide customers a convenient and flexible way to shop for products without worrying about upfront payment. BNPL allows shoppers to break up their expenses into several smaller installments, often with zero interest, making it an attractive option for those who want to purchase big-ticket items.

While some may have viewed BNPL as a passing trend, it has become increasingly evident that it is here to stay. Here are some reasons why:

Nabeel Ghunaim/ Freepik | Across generations, nearly 60% of consumers say they prefer buy now, pay later over credit cards due to the ease of set payments

Convenience

One of the primary reasons for the growth in BNPL services is the convenience they offer customers. With BNPL, shoppers can easily purchase online or in-store without worrying about paying for their items upfront. This gives consumers more flexibility and freedom in their shopping habits, as they can make purchases that may have previously been out of their budget.

Financial Flexibility

Another reason why BNPL is becoming increasingly popular is that it provides consumers with financial flexibility. Instead of making a large payment upfront, BNPL allows customers to spread the cost of their purchases over several installments. This can be particularly helpful for those who may not have the funds to pay for an item in full but still need it urgently.

Interest-Free Payments

Many BNPL services offer zero-interest payment plans, which make it even more attractive for customers. Unlike traditional credit cards, where consumers can accrue high-interest rates over time, BNPL services allow shoppers to pay for their purchases in a more affordable manner.

Pixabay/ Pexels | By 2025, BNPL’s value is expected to reach 12% of total e-commerce market of physical goods

Alternative to Credit Cards

Credit cards have been a popular means of payment for decades, but they come with drawbacks. One major issue is the high-interest rates that can accumulate if payments are not made on time. In contrast, BNPL services often offer interest-free payment plans, making them a more attractive alternative for those looking to avoid high-interest rates.

Expansion in Retail Industry

The BNPL industry has seen significant expansion in recent years, with more retailers offering BNPL services to their customers. This has made it easier for consumers to access BNPL options, contributing to its growing popularity. Major retailers such as Amazon, Walmart, and Best Buy have all started offering BNPL services, which has made it easier for consumers to take advantage of these payment options.

Appeal to Younger Generations

BNPL services appeal to younger generations, who are more likely to shop online and are tech-savvy. Younger shoppers are also more likely to value convenience and flexibility regarding payment options. BNPL services offer an attractive alternative to traditional payment methods, which can be more restrictive and less flexible.

Visa/ Facebook | The fintech company had approximately 147 million active users

The Shift in Consumer Behavior

The COVID-19 pandemic has significantly impacted consumer behavior, with many people turning to online shopping to avoid crowded stores. BNPL services have become even more popular in this context as shoppers look for more flexible payment options for their online purchases. As the pandemic shapes consumer behavior, BNPL services will likely continue to grow significantly in the coming years.

More in Business

-

`

How to Understand Your Energy Bill and Prevent Common Billing Errors

Understanding your energy bill is essential for managing household expenses and catching potential errors. Your energy bill offers a breakdown of...

October 18, 2024 -

`

Is Shawn Mendes’ Relationship With Camila Cabello Finally Clarified?

Recently, Shawn Mendes shared insights into his connection with Camila Cabello during an interview with Jay Shetty. Their relationship, which has...

October 15, 2024 -

`

China Stimulus Fuels Market Surge, But Can It Save the Ailing Economy?

The recent China stimulus measures have sparked renewed optimism in the markets, but doubts remain about whether these efforts will be...

October 10, 2024 -

`

Top 12 Little-Known Savings Tips for Cutting Expenses Fast

Are you looking for the best ways to save money? Saving money often feels like a daunting task, but it doesn’t...

October 10, 2024 -

`

Is Legal Advice from ChatGPT Trustworthy?

Legal advice from ChatGPT may seem like a convenient and cost-effective solution for those facing legal challenges. AI tools like ChatGPT...

October 5, 2024 -

`

James McAvoy’s “Rough” Celebrity Crush Encounter

James McAvoy recently opened up about a memorable yet awkward encounter with his celebrity crush, Jennifer Aniston. Promoting his latest film,...

September 29, 2024 -

`

Everything Business Owners Ought to Know About Staffing

Staffing your business is one of the most critical decisions you will make as a business owner. Whether you are just...

September 20, 2024 -

`

What Chiropractic Services or Products Are Taxable in the U.S.?

When considering sales taxes that come with chiropractors charge, it is important to understand that the rules vary widely by state....

September 13, 2024 -

`

How to Prevent Squatters While on Vacation?

Going on vacation should be a time of relaxation and adventure, not a cause for concern about what is happening back...

September 6, 2024

You must be logged in to post a comment Login