Things You Should Know About Biden’s $25 Billion In Student Loan Forgiveness

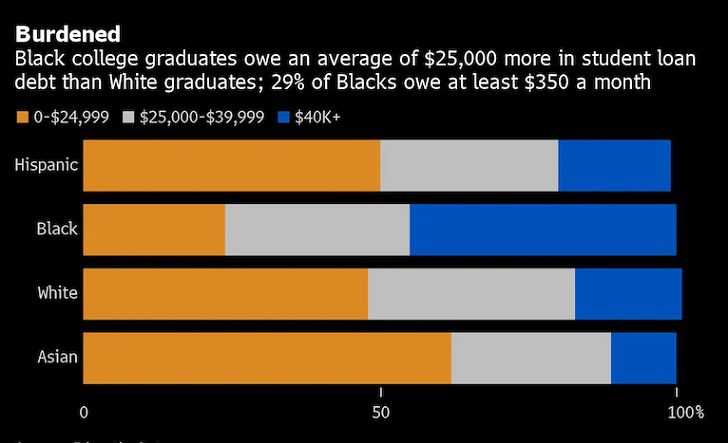

President Biden campaigned on providing $10,000 in blanket forgiveness for all federal student loan holders, a policy that, in any amount, and even with income caps, would be highly regressive: More than half of the loan forgiveness would go to higher-income students, and families.

Blanket student loan forgiveness suffers from a host of other deficiencies, including that it would fail to increase educational attainment, likely increase the price of a college degree, discourage future borrowers from paying back their loans in a timely fashion, and would represent a remarkably shortsighted policy: It would only delay, and not reverse, the historical growth of student loan debt.

Education Data/ Washington Post | candidate, Biden had said he supported a plan for Congress to take action

The cancellation applies to all those who attended schools operated by the now-defunct Corinthian Colleges, one of the largest for-profit education companies that filed for Chapter 11 bankruptcy in 2015.

This analysis finds that, despite the inclusion of income caps, blanket loan forgiveness in any amount would be regressive, meaning that most of the forgiveness would go to higher-income families, as they hold the majority of student debt. As this paper notes, income caps would do little to make such loan forgiveness less regressive. As for those who either do not have student loans, did not attend college (the majority of Americans), already paid off their loans, or attended a community college to contain costs, they would receive nothing. They would instead be among the taxpayers liable for the loan holders’ debt.

THE BIDEN-HARRIS ADMINISTRATION/ Whitehouse | At age 29, President Biden became one of the youngest people ever elected to the United States Senate

During the past year, there’s been debate about Biden’s authority to cancel student debt en masse through executive order. Biden and Speaker of the House Nancy Pelosi don’t think he has the power to do so, but other Democrats, including Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren, say he does, and that Biden should cancel up to $50,000 per borrower.

Since taking office, Biden has announced several rounds of forgiveness, which have gone to borrowers with total and permanent disabilities, public service workers, and borrowers who attended now-defunct institutions. In all, these rounds of forgiveness will aid hundreds of thousands of federal student loan borrowers.

Loan forgiveness for defrauded borrowers

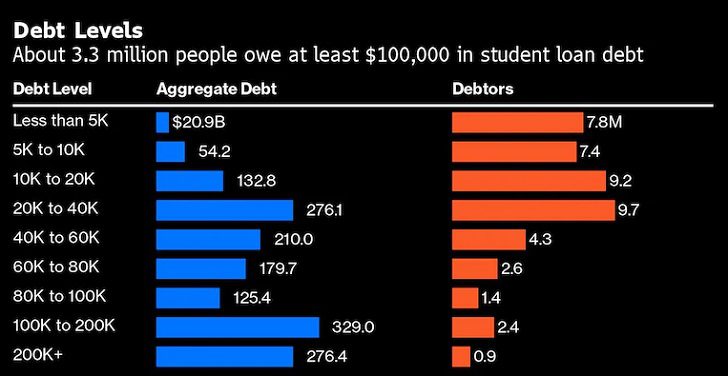

Education Data/ Washington Post | According to Education Department data as of March 2022, more than 45 million borrowers hold federal student loans

According to the Education Department, roughly 690,000 borrowers have had a total of $7.9 billion in student loans canceled through discharges due to borrower defense and school closures, like the group discharge for Corinthian Colleges students. Corinthian Colleges has faced several lawsuits since its founding in 1995, but perhaps the most notable is from 2013, when Vice President Kamala Harris sued Corinthian while she was attorney general of California for “deceptive and false advertising and recruiting” among other allegations.

In March 2021, the Education Department announced it would streamline processing for borrower defense claims, which can be submitted by borrowers who have been deceived by their institutions. That announcement and several subsequent rounds of forgiveness have helped more than 100,000 borrowers and totaled more than $2 billion.

Other borrowers receiving debt relief after being defrauded by their school include former students of DeVry University, ITT Technical Institute’s nursing program, Westwood College, and the Minnesota School of Business/Globe University’s criminal justice programs.

More in Financial Planning

-

`

Leo DiCaprio’s Star-Studded 50th Birthday Bash

Leonardo DiCaprio’s 50th Birthday celebrations marked a significant milestone in the life of this Hollywood icon. Known for his legendary performances...

November 19, 2024 -

`

What Does Budget 2024 Mean for UK Business Owners?

In the much-anticipated Autumn Budget of 2024, UK Prime Minister Sir Keir Starmer rolled out some big changes affecting both individuals...

November 13, 2024 -

`

Hollywood Stars Who Stole the Show at the 2024 LACMA Gala

Blake Lively Stuns in Tamara Ralph Couture “It Ends With Us” star Blake Lively made a dramatic entrance at the 2024...

November 12, 2024 -

`

How Can You Leverage Higher Income Limits for Capital Gains Tax Benefits?

As tax laws evolve, understanding how to leverage higher income limits for the 0% capital gains bracket becomes essential for savvy...

November 7, 2024 -

`

Investor David Einhorn Thinks Peloton Can Be Worth Five Times More IF It Cuts Costs

David Einhorn, founder and president of Greenlight Capital, has a bold vision for Peloton. He believes the struggling fitness company could...

November 7, 2024 -

`

How Interactive Matter Maps Improve Legal Research and Planning

Interactive matter maps have transformed legal research and planning by simplifying how law firms manage complex matters. These tools help legal...

November 1, 2024 -

`

The Role of Global Mobility in Business Planning for 2025

In an era where the competition for top talent is fierce, the significance of global mobility in business planning cannot be...

November 1, 2024 -

`

Will AI Legal Advice Empower or Exclude Those in Need of Justice?

The rapid advancement of technology has introduced AI legal advice into the legal profession, creating both excitement and concern. Law firms,...

October 25, 2024 -

`

Trump vs. Harris – Who Does Hollywood Support?

As the race for the White House heats up, celebrity endorsements have become an influential force in shaping public opinion during...

October 22, 2024

You must be logged in to post a comment Login