Why Saving Regret Is Real and How You Can Avoid It

Saving regret is one of those life lessons that hits hardest when it is too late. You might think you are doing okay financially until you realize retirement is closer than you thought, and your savings are not quite where they should be. Saving regret is the sinking feeling of wishing you had saved more earlier in life.

A 2018 study by the National Bureau of Economic Research revealed some startling truths about this regret. The good news? You don’t have to end up in the same boat.

What Is Saving Regret?

The term saving regret was coined to describe the hindsight wish that you had saved more money when you were younger. According to the 2018 study, about 66.6% of people felt this regret. It is not just a passing thought either – it can cause real stress – especially as retirement looms.

Ivan / Pexels / Per the research, high-income and high-wealth individuals reported less regret, which makes sense because they had the means to save more.

But saving regret doesn’t only hit people struggling with money. Many middle-income individuals also face this regret because they underestimated how much they would need or put off saving, thinking they had plenty of time.

Saving regret often creeps up because we are wired to focus on immediate needs and wants over future security. Think about it: That new gadget, vacation, or car feels so satisfying now. The future? It seems abstract and far away. But those small, everyday choices add up.

Every dollar spent today is a dollar that could have grown into much more if saved.

Another factor is a lack of financial education. Many people aren’t taught how compounding interest works or how important it is to start saving early. When you are young, retirement feels like a lifetime away.

Sure! It is easy to think you will have time to “catch up later.” But later often comes faster than you expect, and by then, the lost time is hard to recover.

How to Start Saving and Skip the Regret

The best way to avoid saving regret is to start now, no matter where you are financially. Even if you think you are behind, every little bit helps. The power of compound interest can work in your favor if you give it enough time.

Pixabay / Pexels / Saving doesn’t have to mean huge sacrifices, though. Small, consistent contributions over time can grow into significant sums.

It is also crucial to have a plan. Simply saying, “I’ll save more,” is not enough. Set clear goals – be it a retirement fund, an emergency stash, or future travel. Break these goals into smaller, manageable steps. Automating your savings can make it even easier. You won’t have to think about it, and you will avoid the temptation to spend the money elsewhere.

Why Early Saving Is Critical

Starting early is the golden rule of saving. The earlier you save, the more time your money has to grow. Compounding interest is like a snowball rolling downhill – it builds momentum and grows faster over time. A small amount saved in your 20s can often beat larger contributions made in your 40s or 50s.

For example, imagine you save $100 a month starting at age 25, earning a 7% annual return. By the time you are 65, you will have over $240,000. Wait until you’re 35 to start, and that number drops to about $120,000. Time is your most valuable asset when it comes to avoiding regret.

Overcome the “I’ll Do It Later” Mindset

Procrastination is one of the biggest culprits behind saving regret. It is easy to think, “I’ll save when I make more money,” or “I’ll start next year.” But life has a way of throwing curveballs, and there is rarely a perfect time to start. The truth is, the sooner you begin, the less painful it will be.

Even small amounts saved now can make a huge difference down the line.

More in Financial Planning

-

`

The Role of Global Mobility in Business Planning for 2025

In an era where the competition for top talent is fierce, the significance of global mobility in business planning cannot be...

November 1, 2024 -

`

Will AI Legal Advice Empower or Exclude Those in Need of Justice?

The rapid advancement of technology has introduced AI legal advice into the legal profession, creating both excitement and concern. Law firms,...

October 25, 2024 -

`

Trump vs. Harris – Who Does Hollywood Support?

As the race for the White House heats up, celebrity endorsements have become an influential force in shaping public opinion during...

October 22, 2024 -

`

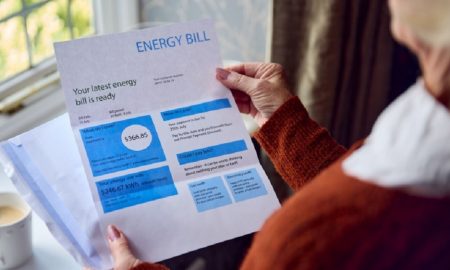

How to Understand Your Energy Bill and Prevent Common Billing Errors

Understanding your energy bill is essential for managing household expenses and catching potential errors. Your energy bill offers a breakdown of...

October 18, 2024 -

`

Is Shawn Mendes’ Relationship With Camila Cabello Finally Clarified?

Recently, Shawn Mendes shared insights into his connection with Camila Cabello during an interview with Jay Shetty. Their relationship, which has...

October 15, 2024 -

`

China Stimulus Fuels Market Surge, But Can It Save the Ailing Economy?

The recent China stimulus measures have sparked renewed optimism in the markets, but doubts remain about whether these efforts will be...

October 10, 2024 -

`

Top 12 Little-Known Savings Tips for Cutting Expenses Fast

Are you looking for the best ways to save money? Saving money often feels like a daunting task, but it doesn’t...

October 10, 2024 -

`

Is Legal Advice from ChatGPT Trustworthy?

Legal advice from ChatGPT may seem like a convenient and cost-effective solution for those facing legal challenges. AI tools like ChatGPT...

October 5, 2024 -

`

James McAvoy’s “Rough” Celebrity Crush Encounter

James McAvoy recently opened up about a memorable yet awkward encounter with his celebrity crush, Jennifer Aniston. Promoting his latest film,...

September 29, 2024

You must be logged in to post a comment Login