Credit Card Loans Soaring Amidst Financial Recession

The looming financial recession is a cause for concern for many. Many are worried about their job security and financial state. But despite this palpable fear of economic hardship, credit card loans continue to soar in popularity and usage.

Moving forward, this trend may be worrying for some but it also offers an opportunity for others to take advantage of the rising consumer confidence in taking out more credit card loans.

Khwan / Pexels / In the last quarter of the outgoing year (2022), credit card loans went up to $986 billion.

What Do Stats Say About the Ratio of Credit Card Loans?

According to the TransUnion data from 2019, the overall loan balance (which includes mortgage, auto, student, and other unsecured debt) was up approximately 7% to $3.96 trillion at the end of 2018. Credit card debt reached $900 billion, an increase of 8% from the prior year. This means that more Americans are taking out credit cards and using them to make purchases and pay for events and services.

And this is a record-breaking increase in credit card debts in a single quarter.

What Drives Credit Card Loan Usage?

One of the main factors driving the increase in credit card loan usage is consumer confidence. People feel more confident in taking out loans when they feel secure about their financial situation. This security comes from having a stable job or income source even amidst economic uncertainty.

Pixabay / Pexels / The sense of security drives the usage of credit card loans.

Moreover, with lower interest rates, consumers are incentivized to take out more credit card loans as they offer more attractive terms than other types of financing such as personal loans or car loans.

How to Manage Credit Card Loans?

Although credit cards offer a convenient way to purchase and pay for goods, services, and events, it is important to remember that borrowed funds must be paid back. Therefore, it is essential to have a plan in place in order to manage your credit card debt.

Pixabay / Pexels / Average Americans should be mindful of their credit card debts – to ensure that they do not get overwhelmed by them.

This includes creating a budget for spending, as well as setting up an automatic payment system so that payments are made on time. Additionally, it could also be useful to review the terms of your loan from time to time. In the long run, this will help you in making you aware of any changes or fees associated with the loan.

Parting Thoughts

Credit card loans continue to soar even amidst financial recession due to increased consumer confidence and attractive terms offered by lenders. It is important to ensure that credit card loans are managed properly by creating a budget, setting up an automatic payment system, and reviewing loan terms from time to time. Although credit card loans can be advantageous in certain instances, it is essential to remember that borrowed funds must be paid back.

By following these simple steps, you will be able to take advantage of the rising popularity of credit card loans while avoiding any financial pitfalls associated with them.

More in Financial Planning

-

`

Everything You Need to Know About Withdrawing Your Notice to Vacate

If you have ever been in the whirlwind of renting, you know the drill: You find a cozy space, sign the...

April 16, 2024 -

`

How Much Is Tony Hinchcliffe’s Net Worth in 2024?

According to the latest updates, Tony Hinchcliffe’s net worth is an impressive $5 million. The comedy star’s growing net worth reflects...

April 10, 2024 -

`

How to Start A Nonprofit in 2024? A Complete Guide

Starting a nonprofit can be a profoundly rewarding venture. After all, it allows you to make a significant impact in your...

April 3, 2024 -

`

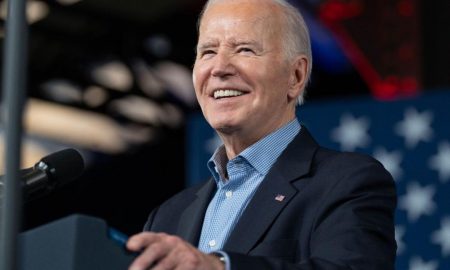

Student Loan News: Biden Administration Approves $4.9 Billion Student Debt Relief Plan

In the latest wave of student loan news, the Biden Administration has made a groundbreaking announcement that brings financial relief to...

March 26, 2024 -

`

Annuity Rates – How Much Will Your Retirement Payout Be?

Planning for retirement is a crucial step towards financial security in your golden years. One tool that can be part of...

March 20, 2024 -

`

Creating a Seamless Marketing Campaign Across All Online Platforms | Some Effective Strategies

Maintain Visual & Tonal Consistency The aesthetic and voice of your brand serve as the cornerstone of recognition and trust. Whether...

March 16, 2024 -

`

How Effective Are Gender-Based Violence Laws?

Imagine a world where the fear of violence doesn’t cast a long shadow over everyday life, especially for women and girls....

March 4, 2024 -

`

6 Essentials of A Successful Startup

The entrepreneurial landscape is a testament to the human capacity for innovation and resilience. Navigating this terrain requires more than just...

February 26, 2024 -

`

Why Most Americans Don’t Know Their Retirement Savings – And What You Should Do About About It!

A new report from the TIAA Institute indicates that a significant portion of the population, about 1 in 4 Americans, is...

February 22, 2024

You must be logged in to post a comment Login