Why Maintaining A High Credit Score Is Extremely Important For Americans?

For Americans, unlike any other part of the world, credit card score is a big deal. If you are looking to buy a house or a new car, the service provider will not see if you have enough cash in your pocket. Instead, they will look for your credit card score. If you have a good credit card score, you can buy whatever you want. Despite the fact that you may not have enough cash in your pocket, you are still good to make purchases – no matter how big or small.

For instance, if you are looking to buy a house, the first thing a real estate dealer will look at is your credit card score. If it is over 710 – AKA a ‘good’ credit score – you will be qualified to buy a house. On the other hand, if your credit score is not ‘good’ or below the threshold, you will not be eligible to buy a house. Likewise, the same applies to other services like buying a car or purchasing a cell phone.

Andrea / Pexels / Unlike anywhere in the world, you will have to maintain a ‘good’ credit score to make purchases – in the United States.

However, this may sound weird to some. But the idea behind the credit score measurement is something worthwhile. It denotes your overall purchase history and if you have any debts.

With that said, here are some of the things that determine your credit score:

– The purchase you make on a daily basis.

– Your previous purchase history.

– The loans that you owe.

– Whether or not you pay your monthly bills on time.

Pixabay / Pexels / Your credit score shows your overall purchase history and loans that you owe to companies.

Thus, your credit score is your grand ambassador in the U.S. Unless you do not have a ‘good’ credit score, you will not be able to make purchases. However, there is one more thing that determines your credit history: Debts. That is right! If you owe money to a company and have not paid them off, your credit score will drop exponentially.

And unless you do not pay these debts off, you will not be able to make any purchases. Whether you’re buying a new car or installing an internet service in your house, it will be extremely difficult for you.

Pixabay / Pexels / Companies use your credit score to measure your financial background.

So, for instance, if your credit score is below average (less than 680,) companies will not trust you. In turn, they will not offer you any services. This could be despite the fact that you have enough funds in your bank account or cash in your pocket.

But since your credit score is below average, it shows that the cardholder is bankrupt. And companies will avoid dealing with you.

Therefore, if you are living in America, you will have to do whatever you can to maintain a solid credit score. If not over 710, at least try to maintain a 680 credit score. Consequently, you will get many benefits. From low-interest rates to making purchases without hustling, you will avail all the perks.

More in Financial Planning

-

`

The Rising Trend of Affluent Families Paying Adult Kids’ Bills

The role of wealthy parents in their adult children’s financial lives has become more significant than ever. A new report from...

October 9, 2025 -

`

Beyoncé and Jay-Z Are Considering Buying a 58-Acre Luxury Estate in the Cotswolds

Beyoncé and Jay-Z appear ready to broaden their real estate holdings with a 58-acre estate near Wigginton, tucked within the Cotswolds....

October 1, 2025 -

`

How to Sell Your Bermuda Home the Right Way

Selling a home in Bermuda involves more than listing a property and waiting for buyers. From understanding local regulations to navigating...

September 24, 2025 -

`

Kraft Heinz Announces Major Split Into Two Companies

In a major strategic pivot, Kraft Heinz will split into two public companies. Long regarded as one of the most familiar...

September 17, 2025 -

`

How an Overreliance on Crowdfunding Poses Financial Risks

For countless families, crowdfunding has turned into a lifeline during sudden financial crises. GoFundMe and similar platforms allow loved ones—and even...

September 10, 2025 -

`

Five People Charged in Matthew Perry’s Death – Full Details

The death of Matthew Perry on October 23, 2023, shocked fans worldwide, sparking an investigation that revealed a complex network of...

September 5, 2025 -

`

Here’s Why Every Couple Should Consider a Prenup Before Marriage

Marriage is often seen as a celebration of love, trust, and commitment. But alongside the romance, there’s a practical side that...

August 28, 2025 -

`

PepsiCo Faces Tariffs, Health Trends, and Price Hurdles – Can It Bounce Back?

PepsiCo stands as one of the most influential players in the global snacks and beverages sector, generating nearly $92 billion in...

August 21, 2025 -

`

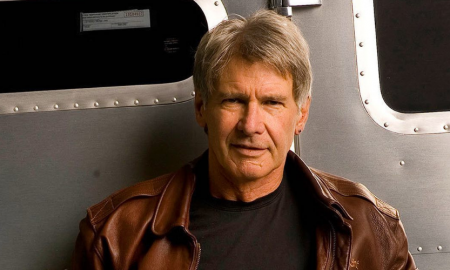

From “Pretentious” to Legendary | The Harrison Ford Story

Before he was the legendary “Indiana Jones” or the iconic Han Solo, Harrison Ford faced a crossroads that could have changed...

August 13, 2025

You must be logged in to post a comment Login