4 Budgeting Tips You Should Avoid at All Costs

Have you ever felt that your money is getting wasted? As if the more you try to save it, the more it slips from your hands? If you have, you’re not alone!

Almost every other person, be it a five-figure salary individual or beyond that, struggles while putting their money to good use. People either spend too much or save too much, failing to find a midground.

Towfiqu Barbhuiya/Unsplash | To begin accumulating wealth, start using sensible budgeting practices immediately. And most importantly, try to avoid any bad budgeting suggestions

If you too belong to this category and worry that by the time you retire, you’ll have nothing in hand, start using sensible budgeting practices immediately. Most importantly, try to avoid any bad budgeting suggestions, like the ones given below.

#Bad Tip 1 – Review last year’s spending to get an estimate

Many experts suggest people analyze previous years’ spending to know where they used most of their money. They ask them to check if the expense was a one-time thing or a regular one. In our opinion, though it’s a nice way of understanding one’s outlay and mistakes, it’s a tedious process too.

Most of the time, people don’t want to take so much pain and recollect what they did a year ago. For such people, the best way out is to look back on last month’s expenses. Once you know your necessities and wishes, you can plan next year’s budget accordingly. Also, don’t forget to include your plans in that budget.

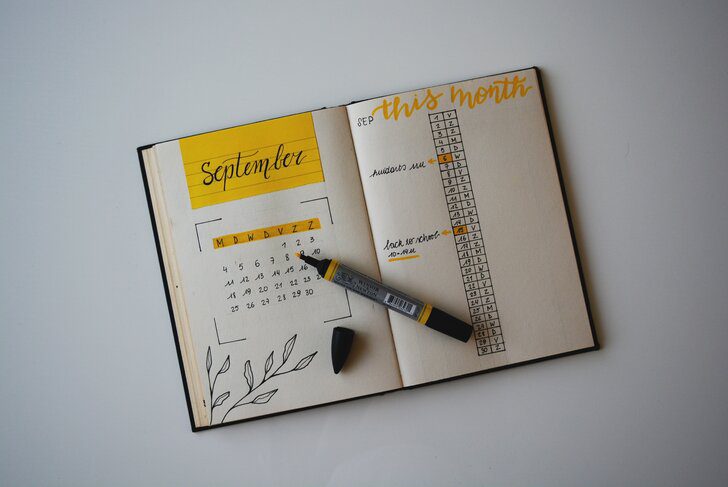

Estée Janssens/Unsplash | Look back on last month’s expenses, and once you know your necessities and wishes, you can plan next year’s budget accordingly

#Bad Tip 2 – Tracking every penny is a must

You might have heard people say that if you’re not tracking every penny, your budget doesn’t make any sense. That’s absolutely incorrect! Noting down every little expense from the bus fare to the coffee you drank at the restaurant is more complicated and time taking.

At times you might not even remember things bit by bit, so try to be less elaborate as much as you can. Make broader subheads like food, traveling, etc, and note down the spendings below them. That way, you won’t lose track of expenses and will save a lot of time.

#Bad Tip 3 – Save until it’s a do or die situation

The biggest mistake one can make is to kill all his wishes and run after every little penny. Remember, we are humans! If we restrict ourselves too much, there will come a day when we will grow impatient, and all our efforts will go in vain.

If you don’t want that, save up to a limit and spend when you feel it’s necessary. Start by saving a small amount and then increase it slowly. And please make sure that your goals aren’t unrealistic, ‘cuz when we fail to achieve them, it hurts more.

Annie Spratt/Unsplash | The biggest mistake one can make is to kill all his wishes and run after every little penny. Remember, you are human!

The Bottom Line

Budgeting isn’t a challenging task. If you start focusing on your needs and eliminating the expensive wants, you can quickly achieve your goals. Who knows, you might even save enough to fund your next holiday or investment. So what are you waiting for? Start planning now!

More in Financial Planning

-

`

Why Is My Gas Bill So High in the Winter? Top Reasons You Need to Know

Why is my gas bill so high in the winter? High gas bills arise when the temperature drops, and households begin...

August 23, 2024 -

`

How to Start a Taxi Business With One Car – And Be Profitable

The online taxi booking app industry is a goldmine in today’s market. It offers unmatched convenience for commuters, lucrative opportunities for...

August 16, 2024 -

`

Can You Go to Jail for Driving Without a License? Find Out Now

Driving is an essential part of daily life for many people, but it comes with responsibilities. One of the most fundamental...

August 9, 2024 -

`

Top 5 Richest “American Idol” Winners

“American Idol” has been a launching pad for many aspiring singers since its debut in 2002. The show has produced some...

July 29, 2024 -

`

Can Banks Notarize Documents for Free?

Navigating the landscape of legal documents can often lead you to one crucial service: notarization. Understanding whether you can access these...

July 23, 2024 -

`

5 Tried & Trusted Ways to Get Quality Property Clients

Wondering how to get property management clients? In today’s competitive market, securing high-quality property management clients can be a challenge. But...

July 17, 2024 -

`

If You Get Married in Vegas, Is It Legal Everywhere?

Las Vegas – the city of bright lights, electrifying energy, and…weddings? Absolutely! While renowned for its casinos and extravagant shows, Vegas...

July 12, 2024 -

`

What Is Jax Taylor’s Net Worth?

Jax Taylor, the unforgettable personality from Bravo’s hit show “Vanderpump Rules,” has become a reality TV mainstay. His larger-than-life persona, dramatic...

July 1, 2024 -

`

Here’s What Happens to Stock Options When a Company Is Acquired

When a company gets acquired, the acquiring company often has a set strategy for dealing with stock options. These strategies can...

June 26, 2024

You must be logged in to post a comment Login