How To Build Your Wealth: Tips From Self-Made Money Experts

Becoming a millionaire can seem like an impossible goal but it’s not necessarily out of reach. The millionaire population in America has risen drastically since the pandemic and is expected to rise even more in the next three years. Balancing out your finance books, budgeting, and proper money-handling can surely make you rich but knowledge and a motivated mindset is the key element that keeps you pushing towards your goal. As a matter of fact, millionaires and billionaires, even those that are self-made, are generally well-read people. They all have learned new ways and explored different avenues on how to invest wisely, saving more, money management, and ways to embrace their new life, both mentally and physically.

Becoming a millionaire may seem far off or just too impossible to achieve for some – after all, not all of us win the jackpot in the lottery every day. As a matter of fact, many people have become self-made millionaires since the pandemic left us in charge of our own finances and savings. You can seek some help and advice from professional financial advisors and accounts to prevent you from making those rookie mistakes and to stay focused on your goal to become a millionaire. Here are some of the best unconventional money hacks that have helped millionaires become successful.

Start early

Burst/ Pexels | It’s important to be willing to make mistakes

The sooner you start managing, saving, and investing your money, however, limited, the better off you’ll be as long as you avoid mistakes like throwing all your investment money into one stock. Saving early means your money is invested for longer and has more time to grow, and any returns your savings make is also reinvested and have a chance to grow too. Increasing your payments in the future may give you a better chance to improve your quality of life in retirement.

Keep your home simple

Billionaires can afford to live in the most exclusive mansions imaginable, and many even do live a simple life. For example, Bill Gates’ sprawling 66,000-square-foot, $147.5-million mansion in Medina, Washington. Yet frugal billionaires like Warren Buffet choose to keep it simple. Buffet still lives in the five-bedroom house in Omaha that he purchased in 1957 for $31,500. Likewise, Carlos Slim has lived in the same house for more than 40 years.

Dustin Demmerle/ Pexels | Never let the fear of striking out keep you from playing the game

Constantly pursuing things you don’t need puts you on a financial treadmill, not an upward escalator. Consumerism is seductive, especially in the digital age, where goods are just a few clicks away. Putting that money into investments and your long-run financial health will help you accumulate more wealth.

Find your passion

Andrea Piacquadio/ Pexels | There’s no bad time to innovate

Staying committed to your passion helps you become what you believe. You are what you are today in your life based on everything you believe in. Your passion could be related to anything you find interesting; this could also include sewing, animal rescue, advertising, creating software or production of a new innovative product. And if you are seeking someone to speak to one-on-one, such as a financial advisor, make a point to ask about the fees they charge. They should be able to be transparent about what their services cost, as well as clear on explaining your money and investments to you.

More in Rich & Famous

-

`

How Pricing Techniques Can Maximize Profits and Customer Loyalty

Businesses today face rapidly changing market dynamics that require agility and precision to remain competitive. One effective way to adapt is...

December 11, 2024 -

`

How Growing Up Poor Affects Your Mental Health?

The experience of growing up poor leaves a lasting impression on a person’s mindset, relationships, and approach to life. Poverty often...

December 6, 2024 -

`

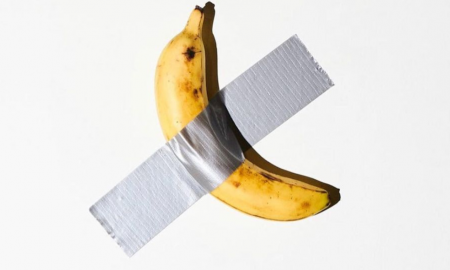

How the Art Basel Banana Became a $6.2 Million Masterpiece

The Art Basel Banana, officially titled Comedian, created waves when it sold for $6.2 million at Sotheby’s auction. Maurizio Cattelan, the...

December 5, 2024 -

`

Why Saving Regret Is Real and How You Can Avoid It

Saving regret is one of those life lessons that hits hardest when it is too late. You might think you are...

December 5, 2024 -

`

5 of the Best Passive Income Ideas for 2024 & Beyond

Everyone dreams of earning money while sipping coffee on a lazy morning or lying on a beach somewhere. That is the...

November 29, 2024 -

`

Facing Legal Challenges in France? Here’s How to Navigate Them

From July 26 to August 11, Paris will welcome athletes and millions of supporters from around the globe to experience the...

November 29, 2024 -

`

The Most Influential Family Offices Driving Startup Investments

In recent years, family offices have become pivotal players in startup funding, investing directly in emerging sectors like artificial intelligence, biotech,...

November 28, 2024 -

`

What Happens When You’re Booked in Jail?

Being arrested and jailed can be an overwhelming experience. The process may not look like the dramatic scenes you’ve seen in...

November 20, 2024 -

`

Leo DiCaprio’s Star-Studded 50th Birthday Bash

Leonardo DiCaprio’s 50th Birthday celebrations marked a significant milestone in the life of this Hollywood icon. Known for his legendary performances...

November 19, 2024

You must be logged in to post a comment Login