Things You Should Know About Biden’s $25 Billion In Student Loan Forgiveness

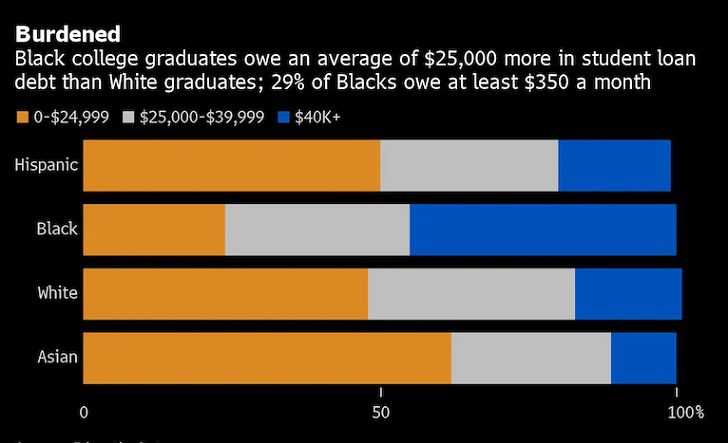

President Biden campaigned on providing $10,000 in blanket forgiveness for all federal student loan holders, a policy that, in any amount, and even with income caps, would be highly regressive: More than half of the loan forgiveness would go to higher-income students, and families.

Blanket student loan forgiveness suffers from a host of other deficiencies, including that it would fail to increase educational attainment, likely increase the price of a college degree, discourage future borrowers from paying back their loans in a timely fashion, and would represent a remarkably shortsighted policy: It would only delay, and not reverse, the historical growth of student loan debt.

Education Data/ Washington Post | candidate, Biden had said he supported a plan for Congress to take action

The cancellation applies to all those who attended schools operated by the now-defunct Corinthian Colleges, one of the largest for-profit education companies that filed for Chapter 11 bankruptcy in 2015.

This analysis finds that, despite the inclusion of income caps, blanket loan forgiveness in any amount would be regressive, meaning that most of the forgiveness would go to higher-income families, as they hold the majority of student debt. As this paper notes, income caps would do little to make such loan forgiveness less regressive. As for those who either do not have student loans, did not attend college (the majority of Americans), already paid off their loans, or attended a community college to contain costs, they would receive nothing. They would instead be among the taxpayers liable for the loan holders’ debt.

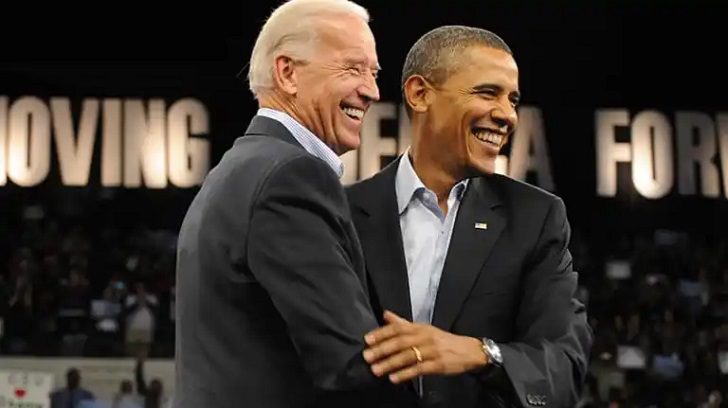

THE BIDEN-HARRIS ADMINISTRATION/ Whitehouse | At age 29, President Biden became one of the youngest people ever elected to the United States Senate

During the past year, there’s been debate about Biden’s authority to cancel student debt en masse through executive order. Biden and Speaker of the House Nancy Pelosi don’t think he has the power to do so, but other Democrats, including Senate Majority Leader Chuck Schumer and Sen. Elizabeth Warren, say he does, and that Biden should cancel up to $50,000 per borrower.

Since taking office, Biden has announced several rounds of forgiveness, which have gone to borrowers with total and permanent disabilities, public service workers, and borrowers who attended now-defunct institutions. In all, these rounds of forgiveness will aid hundreds of thousands of federal student loan borrowers.

Loan forgiveness for defrauded borrowers

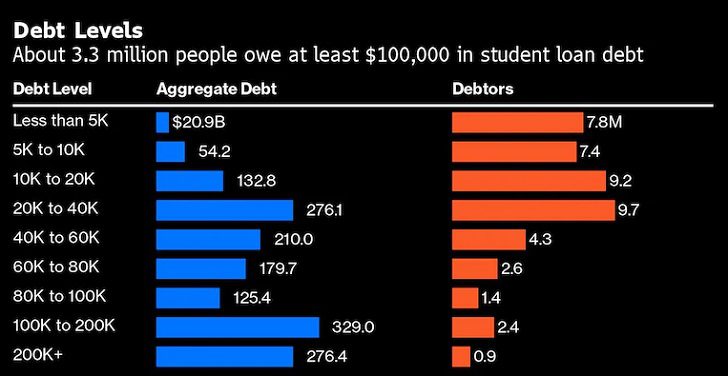

Education Data/ Washington Post | According to Education Department data as of March 2022, more than 45 million borrowers hold federal student loans

According to the Education Department, roughly 690,000 borrowers have had a total of $7.9 billion in student loans canceled through discharges due to borrower defense and school closures, like the group discharge for Corinthian Colleges students. Corinthian Colleges has faced several lawsuits since its founding in 1995, but perhaps the most notable is from 2013, when Vice President Kamala Harris sued Corinthian while she was attorney general of California for “deceptive and false advertising and recruiting” among other allegations.

In March 2021, the Education Department announced it would streamline processing for borrower defense claims, which can be submitted by borrowers who have been deceived by their institutions. That announcement and several subsequent rounds of forgiveness have helped more than 100,000 borrowers and totaled more than $2 billion.

Other borrowers receiving debt relief after being defrauded by their school include former students of DeVry University, ITT Technical Institute’s nursing program, Westwood College, and the Minnesota School of Business/Globe University’s criminal justice programs.

More in Financial Planning

-

`

Here’s What You Should Consider Before Buying A Firearm For Hunting

When kicking off a hunting adventure, knowing what legal requirements must you consider when selecting a firearm for hunting is essential....

June 13, 2024 -

`

Al Pacino’s Kids: Meet the 4 Kids of Hollywood Icon Al Pacino

Al Pacino, the legendary actor, isn’t just a Hollywood icon; he’s also a dedicated father of four. While his career has...

June 3, 2024 -

`

What Will Happen to Your Credit Score if You Do Not Manage Your Debt Wisely?

Have you ever wondered what will happen to your credit score if you do not manage your debt wisely? Managing debt...

May 30, 2024 -

`

How Much Does a McDonald’s Manager Make? A Closer Look at the Fast-food Restaurant Management Salaries

When you swing by your local McDonald’s, it’s easy to notice the bustling activity and the team working swiftly to serve...

May 25, 2024 -

`

How to Get Charges Dropped Before Court Date and Avoid the Courtroom Drama

Facing criminal charges can feel like staring into an abyss, with stress and anxiety building up due to the unknown. The...

May 19, 2024 -

`

How Old Do You Have to Be to Open a Bank Account: And Options For Minors

Navigating the financial landscape can be daunting for anyone. Still, for kids and teens eager to manage their own money,...

May 12, 2024 -

`

Books That Helped Millionaires Become Successful

Becoming a millionaire can seem like an impossible goal, but it’s not necessarily out of reach. The millionaire population all around...

May 1, 2024 -

`

Establishing a Successful Celebrity-Backed Business Brand

Having a celebrity endorse your brand is one of the best ways to generate buzz and get your products noticed. However,...

April 26, 2024 -

`

Some of the World’s Most Valuable Dimes For Colletors

When asking the question “What dimes are worth money,” numismatists – both seasoned and novices – often find themselves fascinated by...

April 24, 2024

You must be logged in to post a comment Login